Market Outlook for 2026

- Speed Financial Solutions

- Nov 27, 2025

- 6 min read

2025 has brought a mixed bag for investors, with a slow start and lower values, followed by outperformance during the second half of the year, particularly in technology and artificial intelligence. Understandably, the burning question on some peoples mind is whether this growth is sustainable, is there any substance behind it, or is it over valued stocks? Those a little ‘longer in the tooth’ like me, will remember the tech bubble bursting in 2000.

Low interest rates in 1998–99 facilitated an increase in start-up companies, but the dot-com bubble burst in 2000, causing numerous startups to fail after depleting their venture capital without becoming profitable. However, some online retailers like eBay and Amazon, survived and later became highly profitable.

Fast forward to today, the U.S. equity market has a market cap of $50 trillion, representing nearly half of global gross domestic product (at $105 trillion), reflecting the U.S.' role as the global epicentre of innovation. Given the exponential pace of advancement in artificial intelligence and technology, that dominance isn't likely to change anytime soon!

REAL GROWTH OR BUBBLE?

One of the biggest threats to stock markets is the artificial intelligence (AI) trade running out of steam. Alphabet, Amazon, and Microsoft announced earlier in November that they are boosting AI spending. Whilst you can never completely rule out a stock market crash, the chances of a big decline in share prices got significantly lower following Quarter 3 (Q3) earnings reports from these companies.

Alphabet, Amazon, and Microsoft all reported earnings earlier in November, and there was a common theme among them. All three reported strong growth driven by high demand and all three announced plans to increase their spending. These results have been viewed as positive news for the stock market as a whole by many market analysts.

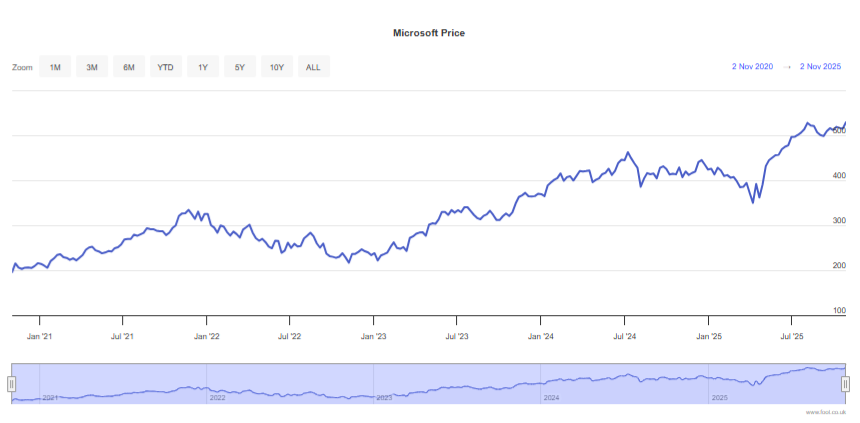

Microsoft

ConsideringMicrosofts results first, this firm has generated 40% revenue growth in its cloud computing business and increased its capital expenditure forecasts. The chart below tracks the Microsoft Price since January 2021.

OpenAI

It’s clear AI stocks are in fashion at the moment, and that makes Microsoft’s stake in OpenAI an interesting development. OpenAI has gone from being a non-profit organisation to a capped-profit one. And this is leading a lot of analysts to think the company might go public in the near future. Microsoft is positioned to benefit from this should it come to fruition. Its overall returns would be limited by the capped-profit model, but it could still realise a significant return on its initial investment.

Amazon

This has been one of the highlights of earnings season so far. After the company posted its Q3 results, its share price shot up more than 10%. For the quarter, revenue was up 13% year on year to $180.2bn. There has been a reacceleration in cloud computing (AWS), resulting in growth in this area of technology of 20% – the fastest rate since 2022 (analysts had been expecting 18%).

Whilst this wasn’t as high as the level of growth that Microsoft (40%) and Alphabet (34%) generated in cloud computing. Amazon is a bigger company so it’s unlikely to grow as fast.

Another highlight was revenue from digital advertising (where Amazon is the third largest player in the world today). This was up 24% to around $17.7bn.

I believe this company has great potential for long term growth in the years ahead. Not only does it have it’s online shopping business, it also has a fast growing cloud computing division (which just announced a partnership with OpenAI), its own high-powered computer chips, digital advertising, self-driving cars, and space satellite operations.

Here's a graph showing the increase in Amazon’s price since January 2021.

Of course, we also need to bear in mind that there could be a slowdown in online shopping due to consumer weakness, competition in cloud computing, and disruption in digital advertising (eg consumers ordering goods directly from ChatGPT). For now though, the future could hold great potential for Amazon!

Technology and AI stocks

The top five companies in the S&P 500 (tech giants Nvidia, Microsoft, Apple, Alphabet and Amazon) now represent nearly 30% of the S&P 500. If you own an S&P 500 index tracker fund, artificial intelligence is already a major part of your investment strategy. Currently, AI accounts for a lot of the S&P 500 and this sector has proved very popular among investors.

One of the things that could derail this is one of the major cloud computing companies deciding to cut capital expenditures. Such a move could negatively affect companies with high exposure to AI hardware demand, including Nvidia and the market as a whole.

Crash potential

The stock market could suffer a downturn for any number of reasons – a potential AI bubble is just one of them. Other risks include a potential recession and higher inflation. Equity markets can be volatile, and there are a range of economic and/or sector-specific factors that can lead to periods of decline.

Those are still possibilities, and investors need to be ready for a downturn at any time. But the promise of higher capital expenditures seems to have fended off the AI risk, at least for the time being.

Lowering risk through Diversification

For decades, investing in exchange-traded funds or mutual funds that follow the S&P 500 was viewed as a relatively low-risk way to grow wealth over time. Market legend Warren Buffett famously endorsed “set-it-and-forget-it” strategies using low-cost index funds.

But that approach may not be as diversified as it once was. For instance, if your entire portfolio for retirement is in the S&P 500, regardless of what’s happening in the AI market, it really isn’t well diversified.

Outlook for 2026

Some analysts have forecast that US equities are likely to outperform global peers in 2026, suggesting that the S&P500 will rise to 7,800 in the next 12 months—a 14% gain from its current level, compared with expected gains of 7% for Japan’s TOPIX and 4% for the MSCI Europe.

There will of course be some bumps along the road, markets will remain sensitive to economic and geopolitical developments. The current forecasts though, are broadly optimistic as we move towards 2026.

Summary

It’s important to get advice specific to your particular situation, diversification and how you hold your assets can have a big impact on the potential investment growth and tax you and your loved ones pay in Spain AND the UK. Our aim is to ensure that you are able to enjoy life while we take care of your finances, ensuring you’re set up in the most tax efficient way for your particular circumstances. If you are thinking about how best to navigate life in Spain, please do contact us, or book a free 30 minute consultation via our website.

Speed Financial Solutions are a highly qualified and regulated financial services provider looking after clients throughout Spain and the UK. Established in 2010, we provide a discreet and comprehensive service to individuals, and our service is tailored to suit your needs.

Our Principal, Andrea Speed, is a qualified Discretionary Investment Manager specialising in Investment and Risk, Taxation and Trusts, and a qualified Pension Specialist. Andrea is also a Fellow of the Chartered Insurance Institute (CII), which is the world’s largest professional body for insurance and financial services in the world.

Fellowship is the highest qualification awarded by the CII (Level 7) and is universally regarded as the premier qualification. It is a major achievement in the financial industry and demonstrates the acquisition of skills and knowledge at the highest of levels. Along with a Fellowship, Andrea is a CII Chartered Financial Planner.

Please take a look at our website – www.speedfinancialsolutions.com

For further information contact us on Tel 951 315 271 or 951 318 529

We are happy to discuss your own situation in more detail. One of our advisers would be pleased to spend some time with you either in your home or at our office to review your current savings, investments and pensions, so do call to make an appointment. Our Financial Review is completely free of charge and without obligation. Follow us on Facebook for regular updates.

The views and opinions expressed above are those of Speed Financial Solutions and are provided for general information purposes only, based on our understanding of current legislation and practices, which may change. This communication does not constitute investment advice, personal recommendations, investment research, or an offer to buy or sell any financial instrument. Readers should consider their individual circumstances and seek independent regulated financial advice before making any investment decisions.

Past performance is not a reliable indicator of future results, and the value of investments can fall as well as rise. Any forecasts or forward-looking statements are not guarantees of future performance and involve risks and uncertainties.

Please note that regardless of qualification level, Speed Financial Solutions are not regulated or licensed tax advisers. Tax treatment depends on individual circumstances and may change, and we strongly recommend seeking independent tax advice. While every effort has been made to ensure the accuracy of the information in this communication, we accept no responsibility for any errors or omissions.

Andrea J Speed FPFS (DM), M.A.

Principal, Fellow and Chartered Financial Planner

Speed Financial Solutions

27 November 2025

Comments